Loan amortization is a strategic process for first-time homebuyers to manage mortgage debt through fixed monthly payments that reduce both principal and interest over time, ensuring long-term financial stability and savings. Key factors include loan amount, interest rate, term, and ongoing assessment for informed decision-making. Effective management optimizes costs, promotes equity buildup, and aids in meeting financial goals.

For many first-time homebuyers, understanding loan amortization can feel like navigating a complex labyrinth. This crucial financial concept, however, is the key to unlocking long-term stability and clarity in homeownership. Loan amortization refers to the process of paying off a mortgage through regular payments that gradually reduce both the principal balance and interest over time. By demystifying this process, we empower buyers to make informed decisions, ensuring they grasp the full implications of their mortgage choices. In this article, we’ll break down loan amortization in straightforward terms, providing valuable insights for those taking the first steps into the world of homeownership.

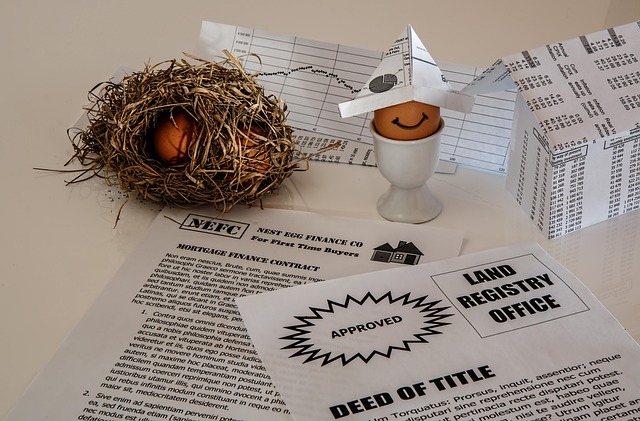

Understanding Loan Amortization: A First-Time Buyer's Guide

Loan amortization is a critical concept for first-time homebuyers to grasp, as it directly impacts their financial journey towards homeownership. It refers to the process of paying off a loan in regular installments, typically over a fixed period, with each payment reducing both the principal (the original amount borrowed) and interest accrued. Understanding loan amortization allows borrowers to budget effectively, make informed decisions, and ultimately save money in the long run.

When you take out a mortgage, the lender breaks down the total cost into monthly payments. Each payment includes a portion dedicated to paying off the principal and another for covering the interest. Over time, as the principal decreases with each payment, the proportion of interest paid diminishes. This is where loan amortization comes into play—it ensures that the borrower pays off the debt in a structured manner. The schedule outlines specific amounts allocated to principal and interest for each period, providing borrowers with clarity on their financial obligations.

For instance, consider a first-time buyer securing a 30-year mortgage. Loan amortization over this period will result in 360 monthly payments. Initially, a larger portion of each payment goes towards interest, but as the loan progresses, more funds are applied to the principal. This strategic distribution ensures that at the end of the term, the borrower has fully repaid the loan. Borrowers should be mindful that their initial payments might feel less impactful due to the high-interest component, but over time, these regular contributions chip away at the debt until it’s eventually cleared. Effective management of this process is a key responsibility for any borrower and can significantly influence financial stability.

How Loan Amortization Reduces Monthly Payments Over Time

Loan amortization is a critical concept for first-time homebuyers to grasp as it directly influences their monthly financial obligations. This process refers to the systematic repayment of a loan by making regular payments that reduce both the principal balance and interest accrued. Over time, these structured payments significantly decrease the overall cost of borrowing, which is particularly crucial for borrowers with substantial loan amounts.

The power of loan amortization lies in its ability to lower monthly payments as the loan matures. When a borrower takes out a mortgage, they are essentially committing to repaying the lender over an extended period. Initially, a large portion of each payment goes towards interest, meaning less is applied to the principal balance. However, through consistent amortization, each subsequent payment reduces more of the principal, requiring less interest to be paid. This shift ensures that borrowers gradually build equity in their properties while managing affordable monthly costs.

For instance, consider a $300,000 mortgage at 4% interest over 30 years. A borrower’s initial monthly payments might cover around $1200 in interest and leave a smaller amount to reduce the principal. Over time, as loan amortization takes effect, these payments evolve, with a larger share allocated to principal repayment. This natural progression not only minimizes the total interest paid but also provides borrowers with a clear path to full ownership. Understanding this process empowers first-time buyers to make informed decisions regarding their financial future and manage their loan obligations effectively, fulfilling their borrower requirements over the long term.

Calculating Loan Amortization: Key Components Explained

Loan amortization is a critical aspect of understanding your financial obligations when securing a mortgage. It refers to the process of paying off a loan in regular installments over time, typically through fixed monthly payments. The primary goal is to ensure that each payment includes both a portion of the principal (the original loan amount) and interest (the cost of borrowing). This meticulous breakdown allows borrowers to track their debt reduction and plan for long-term financial stability.

Calculating loan amortization involves several key components, each playing a vital role in shaping the borrower’s experience. At its core, it hinges on the loan amount, interest rate, and the length of the loan term. These variables are interconnected; a higher loan amount generally necessitates larger monthly payments to pay off the debt within the specified period. For instance, consider a $200,000 mortgage at 4% interest over 30 years. The amortization schedule would reveal that each monthly payment comprises approximately $917 towards principal and $865 in interest, showcasing the intricate balance between these elements.

Borrowers must also comprehend the concept of ‘amortization period,’ which refers to the time it takes to fully repay the loan. Common terms range from 15 to 30 years. The shorter the term, the higher the monthly payment but the less interest paid overall. This is a crucial consideration for borrowers, as it impacts their long-term financial strategy. For instance, opting for a 15-year mortgage may result in paying significantly less interest but demands higher initial payments compared to a 30-year term. Effective loan amortization management not only ensures timely repayment but also empowers borrowers to make informed decisions regarding their financial future.

Strategies for Optimizing Your Loan Amortization Plan

Optimizing your loan amortization plan is a strategic move for first-time homebuyers, as it directly impacts their financial journey. Loan amortization refers to the process of paying off a loan in regular installments, with each payment reducing both the principal balance and interest accrued. A well-structured plan ensures borrowers make efficient progress in debt repayment while managing cash flow effectively. The goal is to minimize interest costs over the life of the loan, which can be achieved through various strategies tailored to individual borrower needs.

For first-time buyers, a common approach is to prioritize paying down high-interest debts first and then applying extra payments toward the principal balance. This strategy, often called ‘debt avalanche,’ ensures borrowers save on interest charges while maintaining manageable monthly loan payments. For instance, if you have a $200,000 mortgage at 4% interest over 30 years, paying an additional $500 per month could reduce the loan term by several years and thousands in interest. It’s crucial to consider your financial goals and borrower requirements when deciding on repayment strategies; some loans may offer prepayment penalties, so understanding these constraints is essential.

Another optimization technique involves adjusting the amortization schedule. Borrowers can choose between standard or accelerated schedules, with the latter allowing for larger monthly payments to pay off the loan quicker. This strategy benefits those who expect their income to increase over time, enabling them to afford higher payments without compromising other financial commitments. However, it’s a double-edged sword; while it reduces loan term and interest paid, it may also limit available funds for other investments or savings goals. Therefore, borrowers should assess their financial stability and future prospects before embracing an accelerated amortization plan.

Ultimately, optimizing loan amortization requires careful consideration of personal finances, market conditions, and lender offerings. It’s a journey that involves ongoing assessment and adjustment, ensuring borrowers stay on track to achieve long-term financial goals while managing their mortgage responsibilities effectively.